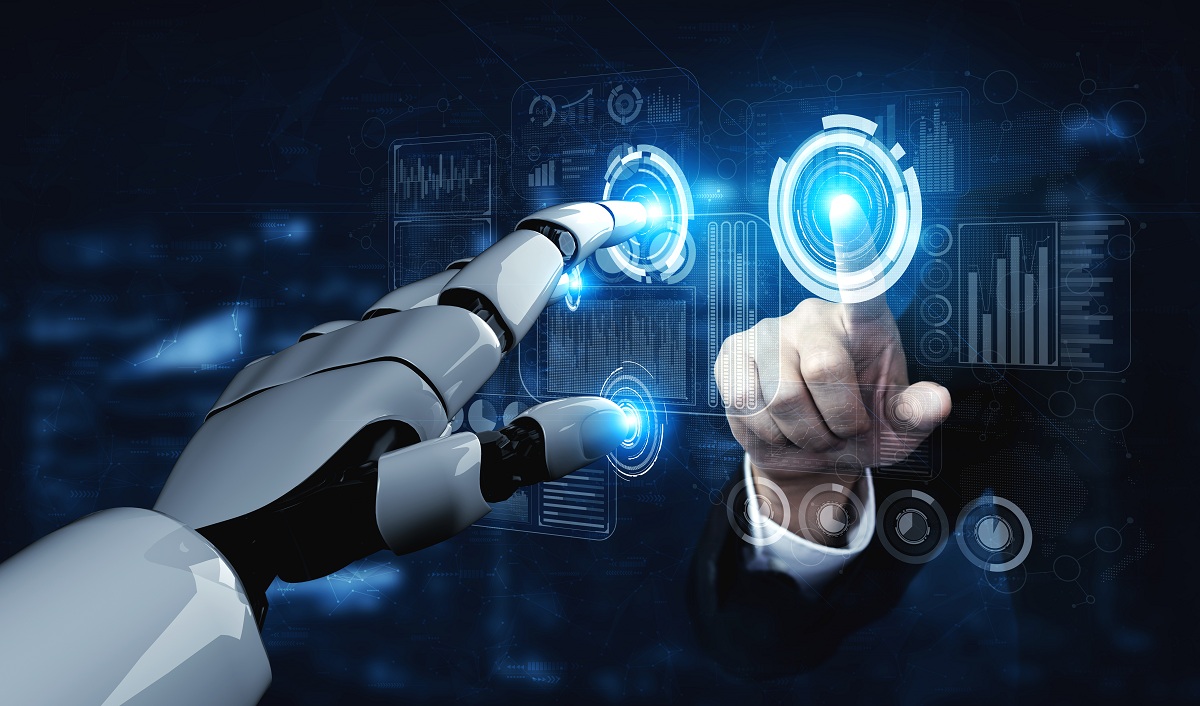

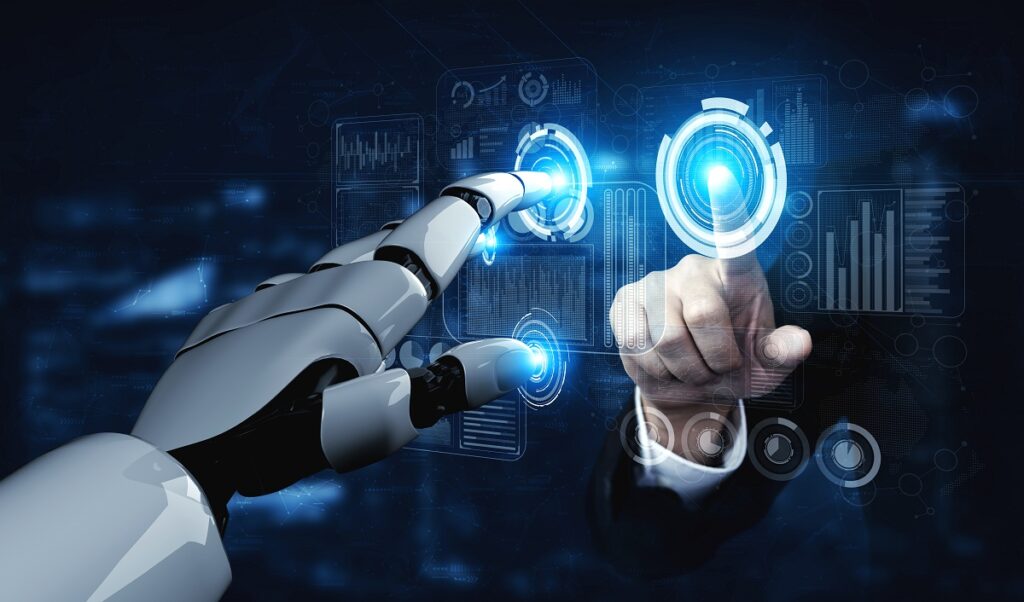

In recent years, the integration of artificial intelligence (AI) in various sectors has revolutionized traditional practices, and the realm of investments is no exception.

With the ability to analyze vast amounts of data, identify patterns, and execute decisions with remarkable speed and precision, AI has emerged as a game-changer in the investment landscape. This article explores the multifaceted ways in which AI is utilized in investments, from portfolio management to trading strategies, risk assessment, and beyond.

Important points about artificial intelligence

Data Analysis and Pattern Recognition:

At the heart of AI’s role in investments lies its unparalleled capacity for data analysis and pattern recognition.

Machine learning algorithms can sift through massive datasets comprising financial indicators, market trends, news sentiment, and even social media chatter to identify patterns that may elude human analysts. By discerning correlations and anomalies, AI systems can generate valuable insights to inform investment decisions.

Predictive Analytics -artificial intelligence :

AI excels in predictive analytics, forecasting future market movements based on historical data and real-time information. Through advanced algorithms, AI models can assess the probability of various market outcomes, anticipate shifts in asset prices, and identify lucrative investment opportunities.

These predictive capabilities empower investors to make informed decisions and adapt their strategies proactively in response to changing market dynamics.

Algorithmic Trading:

Algorithmic trading, or “quantitative trading,” relies on AI-driven algorithms to execute trades automatically based on predefined criteria.

These algorithms can analyze market conditions in real-time, identify arbitrage opportunities, and execute trades with split-second precision, far beyond the capabilities of human traders. Algorithmic trading strategies encompass a wide range of approaches, including trend-following, mean reversion, and statistical arbitrage, among others.

Risk Management – artificial intelligence:

Effective risk management is paramount in investment strategies, and AI plays a crucial role in assessing and mitigating risks.

AI algorithms can analyze portfolio diversification, evaluate the potential impact of market volatility, and dynamically adjust asset allocations to optimize risk-adjusted returns. Moreover, AI-powered risk models can identify emerging risks and stress-test portfolios under various scenarios, enabling investors to make proactive risk management decisions.

Sentiment Analysis:

Sentiment analysis leverages AI to gauge market sentiment by analyzing textual data from news articles, social media posts, and other sources.

By assessing the tone and content of these sources, sentiment analysis can provide insights into investor sentiment, market expectations, and potential market reactions. Investors can leverage this information to gauge market sentiment trends, identify market sentiment extremes, and adjust their investment strategies accordingly.

Personalized Investment Solutions:

AI enables the development of personalized investment solutions tailored to individual investors’ goals, risk tolerance, and preferences.

Through machine learning algorithms, investment platforms can analyze investors’ financial profiles, investment objectives, and past behavior to offer customized investment recommendations and portfolio allocations. These personalized solutions enhance investor engagement, satisfaction, and ultimately, investment outcomes.

Conclusion:

The integration of artificial intelligence in investments represents a paradigm shift in the way investment decisions are made and managed.

From data analysis and predictive analytics to algorithmic trading, risk management, sentiment analysis, and personalized investment solutions, AI offers a myriad of opportunities to enhance investment strategies, optimize portfolio performance, and mitigate risks. As AI continues to evolve, its impact on the investment landscape is poised to grow, unlocking new frontiers and possibilities for investors worldwide.